I have an uncanny sense of timing. Just yesterday, I was commenting to my friend about the new minimum brokerage fee of Rm40 which upsets my way of trading and in today’s Star, I read this article, “Are local brokerage fees too high?” You bet they are, to me, at least.

For the past few days I was ‘fishing’ by placing order to buy 20,000 shares at 0.16 when someone had keyed in at 0.155 and it was last done a day or two ago, at 0.17. It is a small company and the shares were very thinly traded because of the big disparity in prices of buyer and seller which indicated sellers were in no hurry and only those desperate enough would sell at the buyer’s price, which was what I was in for!

Anyway, I had this sudden realisation that someone could have thrown to me at my price but for only the minimum lot of 100 shares! This would cost me Rm16 for the shares and Rm40 for brokerage! OK, this is not realistic as the seller would not sell 100 shares and incur a loss. Even for 1,000 shares, it would cost me Rm160 for the shares and the brokerage works out at 25%! Whatever it is, an increase of 10 sen will only break even and in today’s market, even that seems difficult to come by.

At the start of the downturn in the stock market, I had been buying shares and seeing their prices going south. It used to be ok to buy one or two lots (old 1,000) and see how it goes before buying further. But with the new minimum brokerage fee, it is not feasible and I would say, serve them right if they have seen a reduction in business of 40%. Below is the article I am refering to:

Saturday April 26, 2008

Are local brokerage fees too high?

By LOONG TSE MIN and YVONNE TAN

PETALING JAYA: China's move to cut stamp duty on equity trading, which has boosted that country's stock market since Thursday, has raised questions as to why Malaysian brokerage fees remain so high.

A reader's letter to StarBiz yesterday made a plea to revert to the RM12 minimum brokerage from the current RM40 for stock market transactions via remisiers.

“For an average investor who buys 1,000 shares of an average stock priced at, say 50 sen a share, his purchase will be RM500 and the brokerage fee he pays is RM40.

“In this case, the brokerage is 8% of the principal amount.

“When he sells, he pays another RM40, which means he pays a total of about 16% in brokerage alone. How many counters can move in excess of 16% so that this investor can make a profit?” the reader asked.

Bursa Malaysia Bhd chief market operations Devanesan Evanson told StarBiz that the RM40 minimum brokerage fee was to incentivise remisiers and brokers to increase trading activity.

On whether it was affecting market liquidity, he said it (liquidity) was a product of sentiment and many other factors, such as global economic slowdown and rising oil prices.

“Investors who think the minimum brokerage fee is high are at liberty to trade using the Internet, where the fee is negotiable,” Devanesan said.

Effective Jan 1, commission rates for Internet trading and cash upfront transactions became fully negotiable but the minimum brokerage fee for all other transactions, including those through remisiers, was increased to RM40 from RM12.

However, TA Securities Holdings Bhd head of research Kaladher Govindan pointed out that the revised fee structure could have slowed revenue growth of Bursa Malaysia, going by the stock exchange's first quarter ended March 31 results which saw net profit falling 40% to RM42.1mil compared with the previous corresponding quarter.

He said the RM40 imposed “was a burden” to some retail investors and blamed it for dragging down trading volume.

Remisiers' Association of Malaysia president Sam Ng did not see the cheaper online trading fees luring clients away from remisiers.

In fact, he said online trading was a good supplementary tool to help remisiers reach out to “small-time” investors.

Remisiers could concentrate on larger institutional clients who drove the market, while allowing market participation from smaller investors, he said.

OSK Investment Bank head of operations Lim Ah Lay viewed the current brokerage fee as “competitive” regionally. Singapore's minimum fee, he said, was S$25.

“So far, we have not received any adverse feedback from the investing community on this,” he told StarBiz.

However, he noted that the public expected fees for online trades to be much lower.

As for the remisiers, the current rates were favourable, Lim said.

Asked about the ideal fee structure, he said: “We would prefer a fully negotiable rate structure but with a minimum rate to cover our firm's fixed overheads.”

The Securities Commission (SC), in reply to a StarBiz query, said: “The minimum handling fee of RM40 was requested by brokers and remisiers to reflect the real handling charges incurred by them. This was agreed upon only with the proviso that it does not apply to cash upfront and online trades.

“These trades are now fully negotiable and rates for Internet trades have already fallen well below the minimum of RM12, thus offering a lower cost option for investors.”

The SC added that the introduction of negotiable commission rates was part of a phased approach towards a more deregulated, competitive and vibrant stock market.

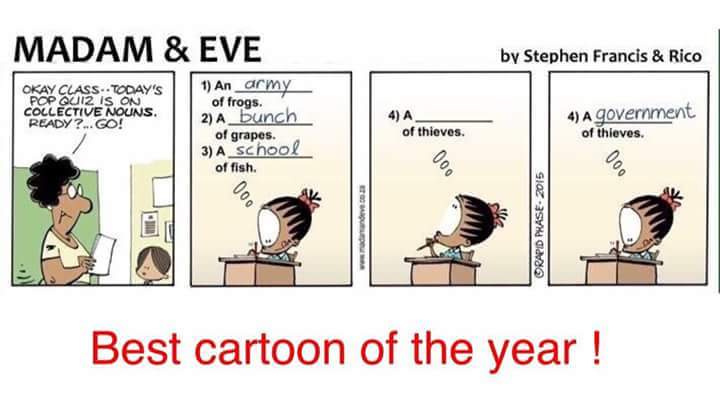

How should we judge a government?

In Malaysia, if you don't watch television or read newspapers, you are uninformed; but if you do, you are misinformed!

"If you're not careful, the newspapers will have you hating the people who are being oppressed, and loving the people who are doing the oppressing." - Malcolm X

Never argue with stupid people, they will drag you down to their level and then beat you with experience - Mark Twain

Why we should be against censorship in a court of law: Publicity is the very soul of justice … it keeps the judge himself, while trying, under trial. - Jeremy Bentham

"Our government is like a baby's alimentary canal, with a happy appetite at one end and no

responsibility at the other. " - Ronald Reagan

Government fed by the people

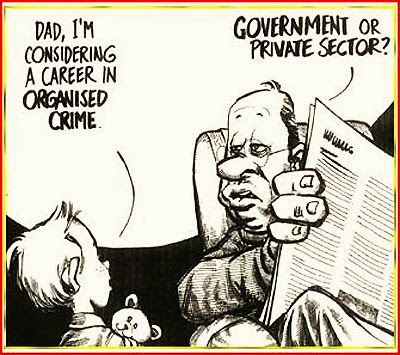

Career options

I suggest government... because nobody has ever been caught.

Corruption so prevalent it affects English language?

Corruption is so prevalent it affects English language?

When there's too much dirt...

We need better tools... to cover up mega corruptions.

Prevent bullying now!

If you're not going to speak up, how is the world supposed to know you exist? “Orang boleh pandai setinggi langit, tapi selama ia tidak menulis, ia akan hilang di dalam masyarakat dan dari sejarah.” - Ananta Prameodya Toer (Your intellect may soar to the sky but if you do not write, you will be lost from society and to history.)

Subscribe to:

Post Comments (Atom)

2 comments:

I agree. Small cap stocks suffer as retail buyers shy from this potential pitfall, yours truly included.

Thanks BH for your comment. It reassures me that someone is reading what I wrote!

Post a Comment