I wish to refer to Tony Pua's post, 'Making it big' which is link to this post.

I always caution about success stories as well as whether someone has had a ‘good life’ or ‘hou maeng’. For the latter, I’d like to quote my late mother who used to say ‘we should leave it to others to judge us and we cannot be sure until the last day of our life’! There are enough stories of dramatic changes of fortunes – the ‘rise and fall’ and ‘fall and rise’ and all the combinations that go with them, especially with reference to our political scenario.

Take the case of Liam Neeson. He could have been continuously successful, if not for having misjudged the market situation with rashness or greed, for example. If I remember correctly, he tried to correct or cover his losses by betting more, but luck wasn’t with him. Businessmen do that too, yet people do not take it as a form of gambling with luck.

The latest financial woes of USA revealed some startling facts about investment banks, which threw caution to the wind with practices, which a conservative bank would not do.

Before the problems came to pass, would anyone question their financial wizardry? While the CEOs were earning super-normal salaries and bonuses, did anyone dare question their ability to continue doing so? The contagion effect is already being felt in other countries, affecting financial traders’ transactions and their bonuses, which are dependent on them, and soon even their jobs, not to mention the collateral damage to national economies too, given the size of the problem.

Being a contrarian, I would agree with Adam Khoo’s love for stock market crashes, as they provide opportunities to buy at very low prices. But for the average investors, most are caught holding shares, which they have bought at higher prices, even after ‘dollar cost averaging’! All of them would be wishing that they have fresh capital to buy the penny stocks but how many would be able to do so? The fund manager of a respectable unit trust or asset management company is able to correct some earlier mistakes with

additional funds from investors. If a person has put all his money into the stock market, he is even faced with the reluctant sale of shares at a loss each time he needs money, and during a recession, the stocks that he could sell at a lower loss are likely to be good stocks which would recover earlier and faster than those ‘no-hopers’.

I can see the difference between a businessman and a timid investor in that the former might even borrow in order to take advantage of the situation, and if proven right, made enough to take bigger risks. Whereas the cautious investor would not want to risk it for fear that he might end up worse off. Looking at it in this context, isn’t this a form of gambling with a dependence on the luck factor as well?

During this bearish market, we can see companies owned by well known industrialists going from bad to worse, from PN17 to PN4, to being de-listed. On the other hand, those under-valued companies are being taken private at reduced costs to major shareholders.

Many businessmen got into trouble because they expanded each time they were successful. A new millionaire will try to be ten-millionaire and then further, until he wants to be a billionaire. At each level of comfort, he could well manage any problems but not at a higher level. But we need such people and there are no shortage of them because money is also power and many people could not resist that.

The moral of my story is that optimists with a good run of luck will enjoy the good fortunes provided they do not run out of luck. But some lucky ones get to be bailed out with public money and that would be unfair.

How should we judge a government?

In Malaysia, if you don't watch television or read newspapers, you are uninformed; but if you do, you are misinformed!

"If you're not careful, the newspapers will have you hating the people who are being oppressed, and loving the people who are doing the oppressing." - Malcolm X

Never argue with stupid people, they will drag you down to their level and then beat you with experience - Mark Twain

Why we should be against censorship in a court of law: Publicity is the very soul of justice … it keeps the judge himself, while trying, under trial. - Jeremy Bentham

"Our government is like a baby's alimentary canal, with a happy appetite at one end and no

responsibility at the other. " - Ronald Reagan

Government fed by the people

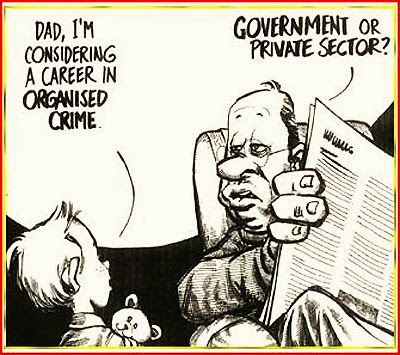

Career options

I suggest government... because nobody has ever been caught.

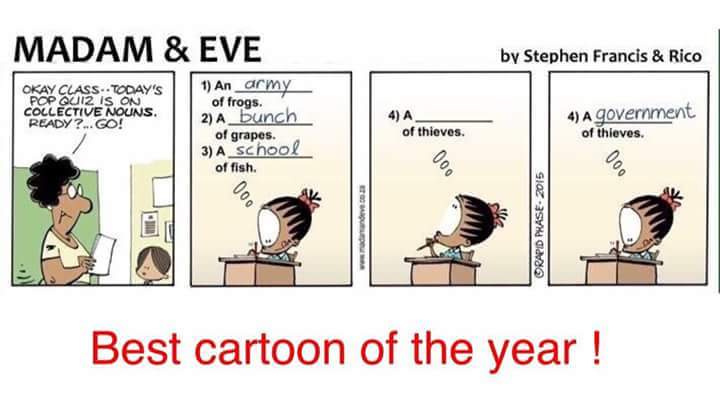

Corruption so prevalent it affects English language?

Corruption is so prevalent it affects English language?

When there's too much dirt...

We need better tools... to cover up mega corruptions.

Prevent bullying now!

If you're not going to speak up, how is the world supposed to know you exist? “Orang boleh pandai setinggi langit, tapi selama ia tidak menulis, ia akan hilang di dalam masyarakat dan dari sejarah.” - Ananta Prameodya Toer (Your intellect may soar to the sky but if you do not write, you will be lost from society and to history.)

No comments:

Post a Comment