New York Times: “As dozens of countries slip deeper into financial distress, a new threat may be gathering force within the American economy the prospect that goods will pile up waiting for buyers and prices will fall, suffocating fresh investment and worsening joblessness for months or even years. The word for this is deflation, or declining prices, a term that gives economists chills. Deflation accompanied Depression of the 1930s. Persistently falling prices also were at the heart of Japan's so-called lost decade after the catastrophic collapse of its real estate bubble at the end of the 1980s."

The above quote was mentioned in the following article:

Why Washington Cannot Prevent Depression Money and Markets: Free Investment Email Newsletter

By Dr. Martin D. Weiss

(Excerpts):

Fear of depression is sweeping the nation.

Millions of Americans are consumed with anxiety, abandoning their old shop-till-they-drop habits, slashing their spending, trying desperately to pinch pennies for the coming hard times.

Thousands of bankers are snapping shut their coffers, tightening their lending standards, hunkering down in anticipation of a massive economic downturn.

Sophisticated investors also see the handwriting on the wall. They're pulling out of hedge funds, selling their mutual funds, rushing their money to the safety of Treasury bills.

(…shortly after the Crash of ‘29 …)

"If the president himself had to call us down to Washington to lecture us on how to run our business, then this economy must be in even worse shape than we thought it was."

They promptly proceeded to do precisely the opposite of what Hoover had asked: They laid off workers by the thousands. They shut down factories. They slashed spending to the bone.

And today, we're beginning to see precisely the same phenomenon:

Washington is prodding consumers to borrow more, spend more, and save less. But consumers are doing precisely the opposite, as we just saw from the October collapse in retail sales.

Washington is prodding bankers to dish out more mortgage money, give people continuing access to credit cards, even lend money to sinking businesses. But the bankers are also doing precisely the opposite, as we just saw in a recent Fed's survey of bank loan officers.

The Ultimate Power of Markets

In fact, in order to run my government, I cannot even dream of raising the money I need without you or without that market.

I need you. I need you to hold the U.S. bonds you've already bought. Plus, I need you to buy more new bonds to finance all my new spending and deficits. You are my lender, my creditor, my benefactor.. I must keep you happy. I cannot afford to do anything that will make you angry.

In fact, by allowing the evolution of this vast market for government securities, I have effectively transferred the ultimate power to make final, critical decisions from me — the government — to you, the investors in government securities. And ...

The power of the market is stronger than any politician or government bureaucrat. It is more powerful than any law. It is even more powerful than the gold standard.

It is also bad news when people do not know where to put their money and they are willing to put it in 1-month US Treasury Bills where they do not earn interest!

In Malaysia:

theSun: Unique challenges in 2009 by Tan Siok Choo

(excerpts):

The International Herald Tribune reported another quirk – investors bought US$30 billion (RM107 billion) of one-month US Treasuries at zero yield. Even more astonishing, demand was so great the US government could have sold four times more than the actual offering.

This abnormality highlights the shell-shocked stance of investors – willing to forego yield in preference for absolute security of capital.

More depressing for Malaysian policymakers, the perception that countries like China and India are immune to the global economic crisis has been shattered.

China’s exports shrank last month, the first decline in more than seven years. November’s 2.2% drop in exports from the year ago figure underlines how rapidly China’s economy has deteriorated, news reports say. In October, China’s exports expanded by 19.2% from a year earlier.

Even more dramatic was the plunge in China’s imports – down 17.9% in November from a year earlier. The erosion of imports indicates weaker domestic demand while the pullback in export orders has wreaked considerable havoc among China’s manufacturers.

Meanwhile, the global slowdown has plunged India’s high-tech companies and outsourcing firms into negative territory. Many of India’s outsourcing companies like Infosys derive two-thirds of their business from the US while one-third comes from financial institutions like Citigroup.

"People think outsourcing is a recession-proof industry. It is not," says Siddharth Pai, a partner in Technology Partners International, a consulting firm that publishes an index of global outsourcing deals. Pai says the index is at a 10-year low.

That industrial powerhouses as well as low-cost developing countries have been caught in the global economic crisis suggests every country is possibly vulnerable. For Malaysian policymakers, complacency is a word that should be deleted from their vocabulary.

How should we judge a government?

In Malaysia, if you don't watch television or read newspapers, you are uninformed; but if you do, you are misinformed!

"If you're not careful, the newspapers will have you hating the people who are being oppressed, and loving the people who are doing the oppressing." - Malcolm X

Never argue with stupid people, they will drag you down to their level and then beat you with experience - Mark Twain

Why we should be against censorship in a court of law: Publicity is the very soul of justice … it keeps the judge himself, while trying, under trial. - Jeremy Bentham

"Our government is like a baby's alimentary canal, with a happy appetite at one end and no

responsibility at the other. " - Ronald Reagan

Government fed by the people

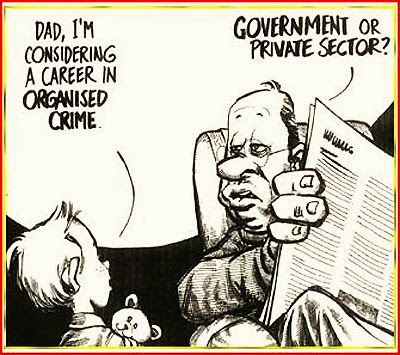

Career options

I suggest government... because nobody has ever been caught.

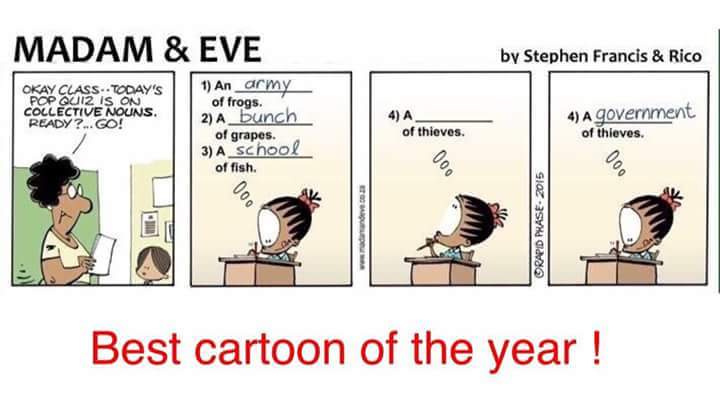

Corruption so prevalent it affects English language?

Corruption is so prevalent it affects English language?

When there's too much dirt...

We need better tools... to cover up mega corruptions.

Prevent bullying now!

If you're not going to speak up, how is the world supposed to know you exist? “Orang boleh pandai setinggi langit, tapi selama ia tidak menulis, ia akan hilang di dalam masyarakat dan dari sejarah.” - Ananta Prameodya Toer (Your intellect may soar to the sky but if you do not write, you will be lost from society and to history.)

No comments:

Post a Comment