According to a leading lawyer, Tommy Thomas, in his letter to Malaysiakini:

"...The reason why contingent liabilities should, as a matter of prudence, be included is because it is in effect "a liability" which may sometime in the future be crystallised.

The largest component under "contingent liabilities" is apparently the guarantee, a long established and widely used financial instrument, which involves three parties; the lender, the borrower and the guarantor.

It arises because the lender is not sufficiently satisfied that the borrower has the financial means to repay his debt.

Accordingly, the lender insists that the borrower's debt be guaranteed by a third party, the guarantor, which then entitles the lender to have recourse against two separate persons (the borrower and the guarantor) in the event that the borrower defaults.

In such a tripartite relationship, the borrower and the guarantor assume legal liability at the time their respective contracts are signed. Thus, the guarantor faces an exposure..."

Rest of his article:

National budget must reflect guarantees by nation

News after publication of the Auditor General's Report ...

Govt-guaranteed debt breaks Rm100 billion mark

In my humble opinion:

Financial management, accounting and

auditing used to be straightforward, and basically, what you see was

what you get. Then a person or a company's net worth could easily be

calculated with the addition of all assets minus all liabilities. Even then it depended on what was known, but what about those items which had

not been revealed? A company's balance sheet might have off-balance

sheet items which were undisclosed but which could have disastrous

consequences. A lot depended on the integrity of the company's

management and its external auditors.

Since then, financial statements of a

large group of companies have become too complex to the laymen, and

even older accountants have problems understanding them. But let's

not fret over that and use simple examples to illustrate my point on

the importance of financial prudence.

A person applying for a housing loan

might be appraised according to his monthly income to ensure he is

able to repay the loan over its tenure. If he has other commitments

like HP loan repayments on his car and other major items, then his

financial capability could be adversely affected and his prospective

housing loan banker might reconsider his application based on such

relevant information. His already stretched financial commitments

could further be burdened if he had acted as guarantor for others'

loans, if and when those borrowers failed to honour their

commitments.

In the old days, banks' ability to pay

their depositors was never questioned. The banks were required to

deposit with Bank Negara, a minimum percentage known as Statutory Liquidity Ratio (now Statutory

Reserve Requirement?) which could be used when there was a run on a

particular bank. The central bank would guarantee all deposits with

the banks under its control. (I believe the old SLR at 20% (when I first read it way back in 1969!) is now the SRR which is currently at 2%)

Recently, it was publicly announced

that banks would guarantee any bank deposit up to Rm 60,000, which

has since been increased to its present Rm250,000. To me, there is

now uncertainty (unlike before) as to whether any commercial bank can

pay back all deposits with them. The complexity of banking must have

reached a stage where nobody knows exactly whether any bank could

withstand a run on it.

There is also concern over

Non-performing Loans (NPLs) within banks which are reported to have

been sold to third parties, including foreign entities. Cases of

housing loan borrowers who found to their shock, that their houses

have been auctioned without their knowledge by third parties, showed

the extent of the problem caused by this illegal selling of NPLs. Of

course, the illegality of such transactions was made legal when

sanctioned by a prior blanket approval by the Minister of Finance.

But the wisdom of it in terms of financial prudence has yet to be

tested.

The situation of NPLs can be serious

because of its size. To put it simply, NPL of a lax bank can easily

be more than its paid capital and reserves. Just imagine if most, if

not all of it, is actually bad or non-recoverable! Doesn't that

remind us of the toxic assets of American banks which caused the

collapse of world's biggest names in banking?

When dealing with finance, prudence is

the key to its sound management. Accountants are trained to follow

this important principle. Stocks are valued at the lower of cost or

recoverable value; debtors are stated, less any known or possible

irrecoverable portion; incomes are recognized when legally proper to

do so and expenses or commitments to spend properly provided for.

By extension, shouldn't this vital

principle of prudence be applied to our country's financial

management? There are currently some complaints about our national

debt being too close to, if not already exceeding the approved ratio; some believe the national

debt was intentionally understated, especially with the omission of

contingent liabilities in the form of guarantees given by the

government.

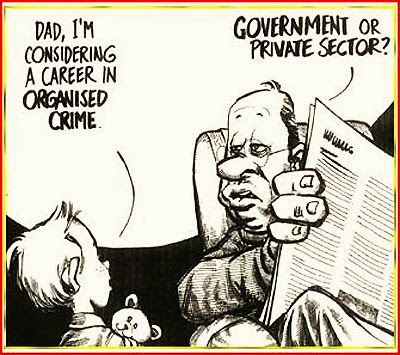

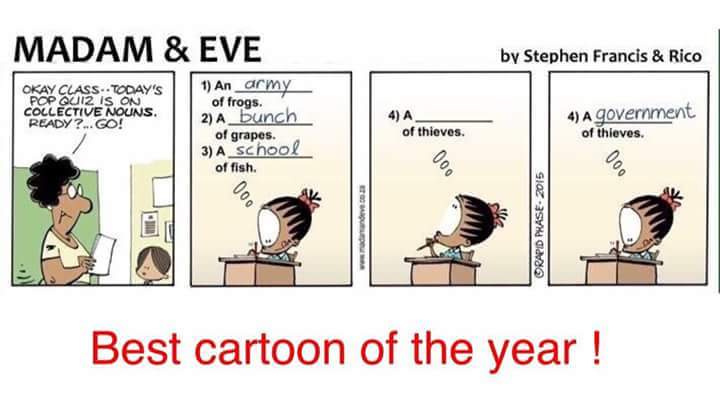

Update: As they say, a picture shows more than a thousand words, the following graphic (courtesy of Martin Jalleh and Malaysiakini) shows our unhealthy public financial situation:

Update: As they say, a picture shows more than a thousand words, the following graphic (courtesy of Martin Jalleh and Malaysiakini) shows our unhealthy public financial situation:

Question: Are there any other hidden liabilities which we are unaware of?

The pensioners and other beneficiaries of BR1M and other handouts are happy, but they wonder where the money is coming from!

2 comments:

Prudence plus integrity. It is difficult to be prudent with money that does not come from your sweat and tears. The rampant paying of full economy fare to MAS in order to be upgraded to Business class is one example. Why can't the Government pay market rate for a flight instead of the listed price? It is like shopping in Petaling Street without bargaining, if at all you need to go there.

Integrity is when you buy what is needed, not what is proposed by a crony. See the number of buses parked in Parcel C in Putrajaya. One would think that it is a bus terminal. But no, the buses are buses owned by various department. They take up valuable parking places, costs a bomb in maintenance, drivers and overtime allowances. Why not just rent when a bus is needed?

Fish rots from the head down.

Thanks for your comment.

Near my house is SMK SYS, a school named after our Sultan's father. They have a coach for school use. No matter how we look at it, it is easier and cheaper to charter a bus if and when necessary.

What about prestige buildings? Most of them were avenues to make a fast buck by those in authority. Felda comes to mind.

Post a Comment